Majority of sovereign wealth funds’ alternatives allocation remains in real estate and private equity: report

The bi-annual State Street Global Advisors report considered 34 of the largest sovereign wealth funds, located in 26 different jurisdictions, which as of year-end 2020, have total assets of approximately $8.5 trillion

Sovereign wealth funds (SWFs) will remain a prominent and diverse group of global asset owners, representing unencumbered fiscal resources of host governments invested under a range of different mandates, according to a recent report from State Street Global Advisors (SSGA).

In its latest report, SSGA considered 34 of the largest SWFs, located in 26 different jurisdictions, which as of year-end 2020, have total assets of approximately $8.5 trillion, representing 5 percent of total global markets.

The bi-annual report highlights the key trends witnessed between 2018 and 2020, including overall asset allocation remaining largely stable with equities continuing to be the largest exposure.

The number of SWFs has shrunk due to mergers, underscoring the SSGA’s previous analysis that fund size is a more important predictor of asset allocation than fund origin or other characteristics.

Size enables greater diversification and higher allocations to alternatives, and therefore supports better performance over the long run.

More than half of the sovereign wealth funds’ alternatives allocation was concentrated in real estate and private equity, with SWFs owning roughly 16 percent of global assets under management (AUM) in the latter industry.

“Surprisingly, SWF returns are similar to those of public pension funds over the past decade, with SWFs benefiting slightly more during risk-on periods,” the report stated.

Between 2018 and 2020, total SWF assets under management (AUM) grew by an annualised 11.3 percent, as compared to 5.5 percent over the previous time period.

Sovereign wealth funds in the Middle East

- The growth in assets under management for sovereign wealth funds in the MENA region reflected the report’s sample trends and accelerated dramatically, up by +9.8 percent annualised over 2018-20, compared to 1.8 percent over the previous time period, also largely due to post-2018 drawdowns across equities.

- The sovereign wealth funds in the MENA region make up 36 percent of SSGA’s total sample, with an asset class profile of 24 percent – cash and FI; 38 percent – public equities; and 38 percent – alternatives on average in 2020.

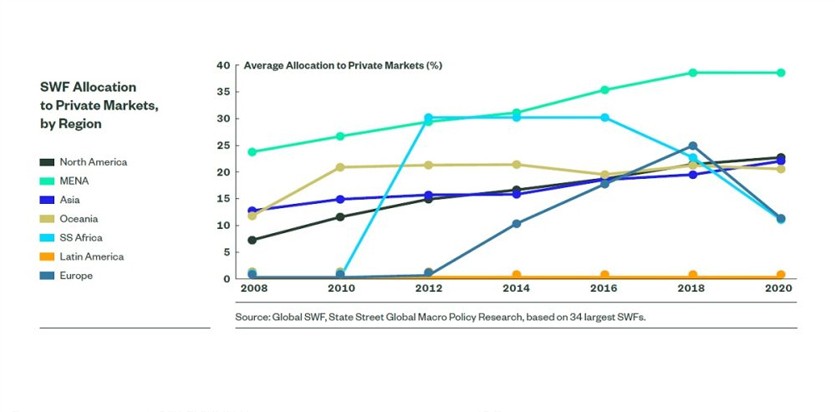

While changes to average asset allocation have remained fairly flat since 2018, albeit with a slight addition to the cash and FI layer, 80 percent of MENA SWFs reduced their public equities allocation by some degree between 2018 and 2020. - Additionally, sovereign wealth funds in the MENA region have historically maintained a high private markets profile, reflective of both fund size and fund origin. They predominantly favour private equity, allocating an average 21 percent of the portfolio to asset class.

State Street Global Advisors’ analysis of sovereign wealth funds has consciously focused on the largest sovereign wealth funds as they exhibit long-term trends and benefit from the classic characteristics of no explicit liabilities and a diversified international asset pool, in contrast to newer funds whose original portfolio may be state-owned enterprises.

This long-term trend shows that SWFs are approaching an equilibrium strategic asset allocation, with any increased alternatives exposure constrained by liquidity needs as well as market supply.

Furthermore, any major shifts in the global economy such as a commodity cycle or geopolitical shifts in the balance of payments surpluses are likely to be mirrored in SWF asset allocation strategies going forward, the report concluded.

Other News

Dubai property sector gains pace bucking global trends

- Business Bay, Downtown Dubai lead 20% growth in real estate transactions in 2019

- Revealed: Areas in Dubai that saw the biggest drop in residential rents in 2019

- Azizi Developments launches unique Sky Villas in Al Furjan

- Dubai shows double-digit growth in residential sales

- Supply-demand gap pares as sales jump, handovers fall

- Designing smarter real estate portfolios in times of uncertainty

Emaar teams up with tech leader for 'Smart Home’

Damac chief says Dubai property prices at 'rock bottom'

Dubai property achieves supply-demand balance, prices hit lowest mark, say developers